A recent article in The PIE News – Customised agent software launched by Dfavo founder – is an interesting swirl in the crystal ball when considering the evolution of the education agent aggregation model and market. The article discusses the release of Firmli, a new software-as-a-service product described as “a purpose-built technology platform for clients in education consultancy, student recruitment and admissions services.” The target customers are education agents.

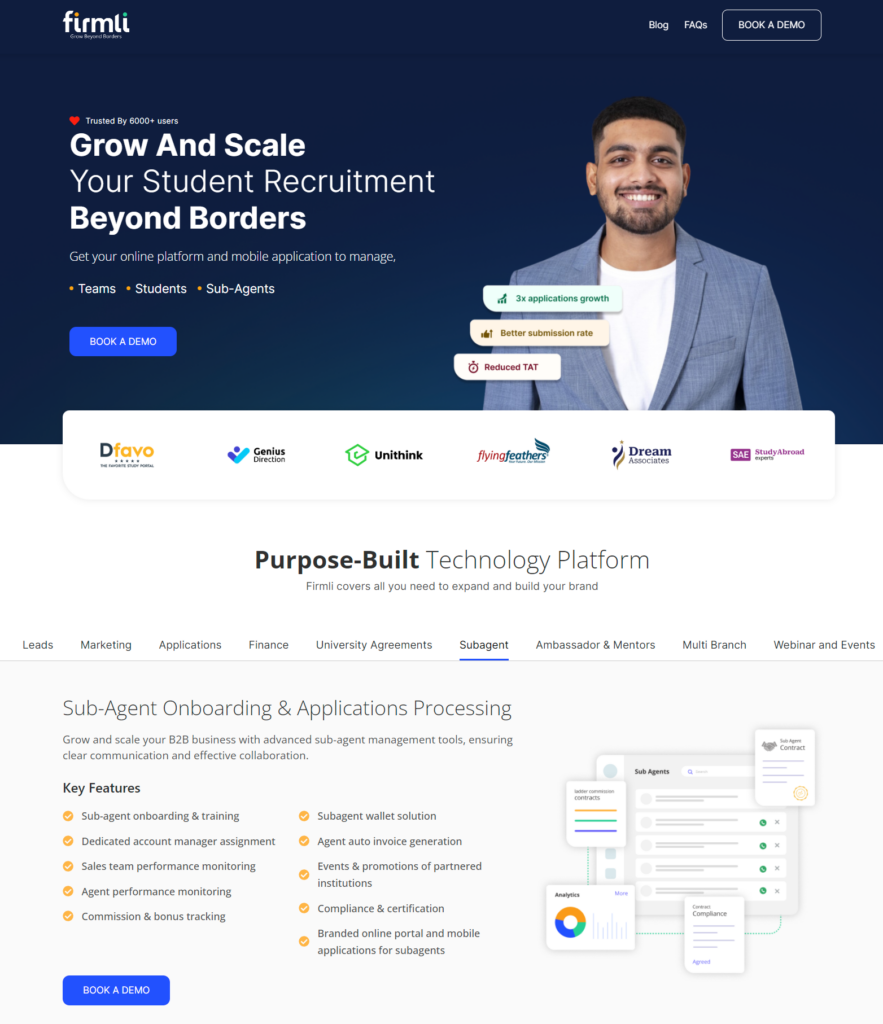

A quick review of the Firmli website shows that part of the value proposition is supporting its agent clients to effectively operate an agent aggregation model by enabling the efficient on-boarding and management of sub-agents.

Back in 2021 the education aggregation business model was a juggernaut. A few key players raced to develop technology platforms that would enable them to efficiently connect educational institutions and education agents, disrupting a market that was traditionally based on bilateral relationships, emails and Excel spreadsheet attachments. Leading the pack was ApplyBoard, which in June 2021 announced that it had raised C$375M in venture capital funding to hit an eye-watering valuation of C$4 billion. Some international education commentators considered the possibility that an “Amazon of aggregators” may emerge and quite rightly raised the associated implications.

In the years since no winner has taken all, at least not yet. No single company has established a monopoly, nor even is there an oligopoly between a few key companies. Instead market players outside the small group of early first movers have themselves moved to compete, building their own technology platforms, competing on price (i.e. commission split) and recruiting their own small armies of sub-agents. As at January 2014 there were at least 14 education agent aggregators with over 2000 sub-agents. That in itself could be taken as a sign of what might be termed ‘aggregator disaggregation’. A market that a few short years ago was looking like it might come to be dominated by one or or a handful of education agent aggregators now has a significant number of players who are running their own education agent aggregation operation.

A key point of difference between the big name agent aggregators and the chasing pack has been the quality of their technology platforms. Rivers of venture capital fund the development of ‘edtech’ platforms with lots of bells and whistles. Initially those seeking to copy the success of the market leaders had little hope of matching the quality and sophistication of their online platforms and the user experience for sub-agents. Those platforms stood as wide edtech moats within which their owners could pursue market dominance.

The technology gap between the market leaders and the others is still there but perhaps it is getting smaller. Over the last few years companies in what may be termed the second tier of education agent aggregators have invested in the development of their own platforms. They may not be as polished as the offerings at the big end of the market but they do enough, and sub-agents may not care too much if they get a better commission split. Sub-agents often have partnerships with multiple aggregators, so they also have the option of using the best platform for the research and counselling phase before switching to another aggregator with the same institutional relationships in place who is offering a better commission split on the student placement.

New products like Firmli have the potential to narrow the technology gap even further, making a full featured sub-agent management platform available to a wider number of medium sized education agents who can use it to scale up their own aggregation businesses. A broader trend is the advent of “no code” and “low code” application development platforms, which lower the barrier to entry by making the tech development process more accessible and potentially removing the need for teams of developers and lots of money to pay them. The master agent / sub-agent dynamic was an entrenched feature of the education agent recruitment market long before the big aggregators arrived. However, giving a larger number of agents easy access to technology that supports them to execute efficiently on an aggregation business model could see more agent aggregators – and perhaps significantly more – hang out a shingle. If that happens the market may quickly leave behind the possibility of a monopoly or oligopoly emerging in the agent aggregation market and move to a new phase of rapid aggregator disaggregation.

Working with education education agents?

AgentBee’s education agent due diligence solution supports educational institutions to implement best practice education agent due diligence processes.

Educational institutions can use it to:

- protect students – conduct initial and ongoing due diligence checks on education agents.

- protect your brand – detect cases of unauthorised agents using your institution’s name, logo or other IP without permission.

Our clients include…

Get new posts…

Follow AgentBee on Linkedin to get our latest posts on education agents as they drop – (click the icon below)