In this post we’re taking a look at how some of the main education agent aggregators have grown their sub-agent networks.

We also explained that that the aggregator business model is a numbers game requiring a critical mass of players on both sides of the market that the aggregator is making – educational institutions and education agents. If one of these elements is missing the business model does not work, at least at scale:

- not enough institution clients and sub-agents may opt to work with an aggregator who has more, and

- not enough sub-agents in source countries means insufficient student application volume to keep client institutions happy, and to generate revenue.

Before we move on, a brief clarity break. Aggregators use different terms for the education agents that they work with. ‘Partners’, ‘recruiters’, ‘recruitment partners’, ‘student counselors’, ‘agents’ and ‘introducers’ all get a run depending on which aggregator website you look at. For the sake of simplicity we’ll use ‘recruiters’ from here on in this post.

Up and to the right…

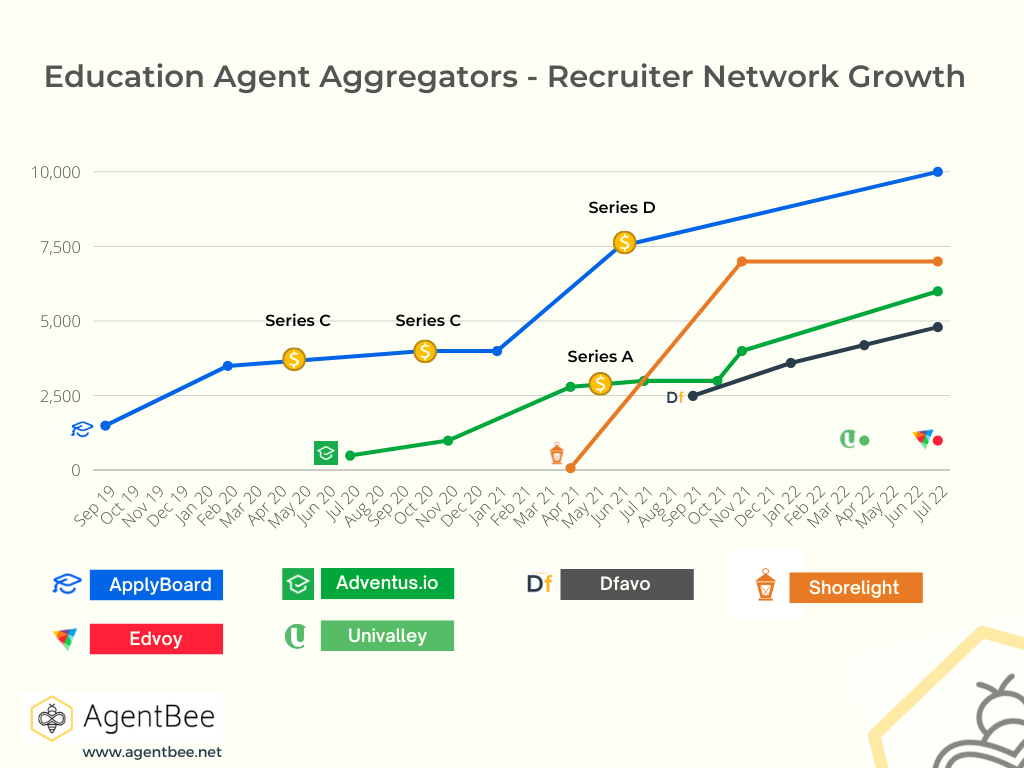

The chart below shows the growth in the recruiter networks of several of the main education agent aggregators over the last few years. The data was drawn from:

- aggregator websites (both current and historical iterations)

- media articles, and

- historical social media posts.

For ApplyBoard and Adventus.io, which have both received venture capital, the dollar signs indicate the approximate dates that the funding was announced according to Crunchbase. ApplyBoard’s Series A and Series B funding rounds were announced in June 2018 and May 2019 respectively, but we could not find any data on recruiter numbers prior to September 2019, so those earlier rounds do not appear.

We’ve not attempted to identify and research every market participant running an aggregator model. Instead we aimed to provide an overview of market trends across a selection of aggregators.

(Note: If we’ve got anything wrong, very happy to be corrected research@agentbee.net)

Points of interest…

- With 10,000 recruiters, ApplyBoard has the largest network by some margin. In second place is Shorelight with 7,000.

- Remarkably, in the space of just seven months between April – November 2021, Shorelight rocketed from just 80 recruiters to 7,500 (based on historical screenshots). Following that growth, the number of recruiters has remained unchanged between November 2021 and July 2022, which was a period of significant recruiter network growth for some of the other players.

- We could only find single data points for Univalley and Edvoy. We’ll update this in future when more data becomes available. We’ll also aim to add data on other aggregators.

- The graph paints a picture of three groups of aggregators in terms of recruiter networks:

(i) ApplyBoard on its own at the top of the tree by some margin.

(ii) A small group in the middle with networks in the 4,500-7,000 range.

(ii) A group of smaller players and new entrants, with smaller recruiter networks.

Working with agent aggregators?

Check out our popular post: 5 questions to ask an agent aggregator about their sub-agents.

Get help with your education agent channel…

AgentBee can support your institution to:

- Grow your global network of education agents.

- Manage the day-to-day relationship with your education agents.

- Implement best practice education agent due diligence.

Liked this post?

Please share this post on with your networks using the buttons on the left. Thanks!

Get an email when we add new content to the blog – click here to subscribe